Wise as a Serpent: Avoid Reverse Mortgages

By Mark Levitt

This article appeared originally in the August 2009 Levitt Letter.

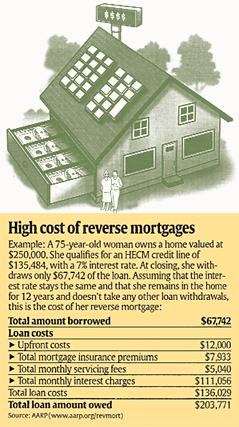

The excerpt below is from the USA Today article, “Reverse Mortgages Can Be Costly as Seniors Cash in On Equity.” The complete article is posted at www.levitt.com/news. The bottom line is that reverse mortgages should be one of the last options for supplementing your retirement paycheck.

A reverse mortgage is essentially a loan that lets seniors 62 or older convert home equity into cash. They don’t have to repay the loan as long as they stay in their home. Interest payments and fees are most often paid when the home is sold or the homeowner dies.

However, reverse mortgages are not right for everyone. They can be costly and complicated in multiple ways.

Aggressive marketers often take advantage of vulnerable homeowners, who can end up paying more than they should for a product that doesn’t work for them, says Sen. Claire McCaskill, D-Mo. She sponsored a bill to help protect seniors from predatory reverse-mortgage lending. It became law in July 2008.

The Home Equity Conversion Mortgage Program (HECM) is run by the Federal Housing Administration and insured by the federal government. Recent changes include:

The Home Equity Conversion Mortgage Program (HECM) is run by the Federal Housing Administration and insured by the federal government. Recent changes include:

The maximum reverse-mortgage amount was raised to $625,500, enough to save many from foreclosure. The loan amount is based on several factors that include the home’s value and the borrower’s age.

Origination fees. Homeowners pay 2% on the first $200,000 and 1% on any amount over that, with the fee capped at $6,000. But the origination fees are only a small part of the expenses. The upfront fees include an insurance premium and standard closing costs—plus there’s a monthly servicing fee and interest.

Home purchase. Homeowners can use an HECM loan to sell their current residence and buy a new one in a single transaction. That helps families who want to downsize, move to a retirement community, or move closer to family members.

AARP offers a free consumer guide, “Reverse Mortgage Loans, Borrowing Against Your Home,” that can be downloaded at www.aarp.org/revmort/. You’ll also see articles there such as “Scam Alert: Reverse Mortgage Seduction” and “5 Questions to Ask When Considering a Reverse Mortgage.”

To consider all of your retirement options (and many other worthwhile stewardship issues), you can visit the website www.decumulation.org, which is offered by the National Endowment for Financial Education, a non-profit foundation. “It is just one part of a retirement strategy,” says Brent Neiser, director of Strategic Programs and Alliances for NEFE. “It has its own set of costs and issues. And it should be one of the last options for supplementing your retirement paycheck.”

Copyright © 2009 Zola Levitt Ministries