Wise as a Serpent: Surviving Equifax

By Mark Levitt

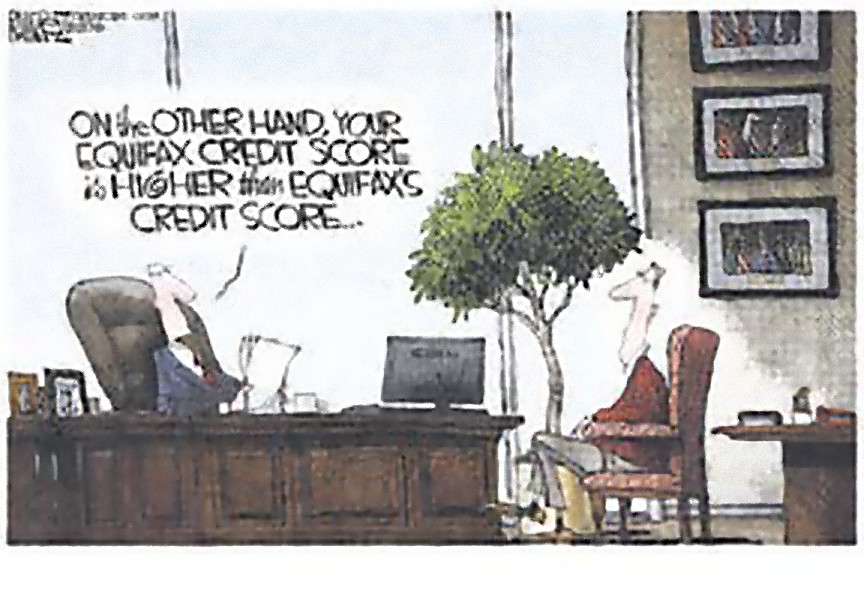

This article appeared originally in the December 2017 Levitt Letter.Thieves recently infiltrated Equifax databases and stole personal credit information for 60% of U.S. adults — names, birthdates, social security numbers, addresses, etc. of as many as 143 million Americans. Reviewing dozens of Equifax breach articles led me to commend the most helpful two:

- ”Everything You Need to Know to Survive the Equifax Data Theft,” by Dave Lieber of The Dallas Morning News.

- ”‘Two-Factor,’ Explained,” by Wilson Rothman, a Wall Street Journal tech editor.

Clicking on “Am I Impacted?” at equifaxsecurity2017.com lets consumers enter a last name and the last six digits of a Social Security number. You would prefer not to get this response: “… we believe that your personal information may have been impacted by this incident.” Despite the outcome, Lieber advises against enrolling in Equifax’s [Dis]TrustedID Premier program. Lieber suggests three actions for guarding against consequences of the recent Equifax breach.

- Do nothing beyond regularly inspecting bank and credit card statements for suspicious activity and reporting it immediately.

- Freeze your credit with all three (3) bureaus online, by telephone, or in writing for both spouses. A freeze lasts until you cancel it altogether or temporarily “thaw” it and involves fees of ~$11 per person per bureau.

Equifax, 800-685-1111

https://www.equifax.com/personal/credit-report-services/credit-freeze/

Equifax Security Freeze,

P.O. Box 105788, Atlanta, GA 30348Experian, 888-397-3742

www.experian.com/freeze/center.html

Experian Security Freeze,

P.O. Box 9554, Allen, TX 75013TransUnion, 888-909-8872

https://www.transunion.com/credit-freeze/place-credit-freeze

TransUnion LLC,

P.O. Box 2000,

Chester, PA 19016 - Settle for the middle ground: put a fraud alert on your identity with any one (1) of the three bureaus. With fraud alerts, whoever pulls your credit report is supposed to verify your consent. Fraud alerts are free, but they last only 90 days, so mark your calendar to regularly reinstate. Regarding checking your credit report, Lieber suggests going to AnnualCreditReport.com, which allows you to check your credit report from each of the three bureaus for free every 12 months. (To cover the year, check a different bureau every four months.) Look for strange accounts or mistakes.

Strongly consider using a two-factor authentication, which requires an extra step after you log in to a website or app to guard against fraudsters; the second step authenticates your identity. That safety measure could involve entering a six-digit code or tapping a pop-up on your cell phone. Mr. Rothman explains: With two factors, hackers need both your password and access to your phone (or to another “second factor,” such as your email) to break in. Every online service worth its salt has a second-step option in its settings. Search Google for “two-factor authentication” plus the company’s website or the app’s name. Being wise as a serpent these days is increasingly complex, but it’s less challenging for us who hone our minds with regular Bible reading. Kindly share this article with anyone less informed than you.

Copyright © 2017 Zola Levitt Ministries