Wall Street: Still a Dark Alley

By Mark Levitt

With His typical compassion, Yeshua admonishes Bible readers as follows: “Behold, I send you forth as sheep in the midst of wolves: be ye therefore wise as serpents, and harmless as doves.” (Matt. 10:16) Easier said than done, right? Particularly with the wolves of Wall Street.

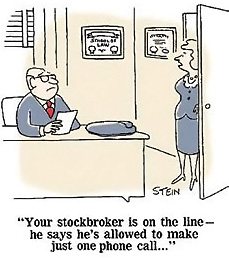

Seventeen years ago, a stockbroker ran Zola, this ministry, and me through the proverbial ringer. That experience and the subsequent, virtually fruitless arbitration inspired me to undertake a more-disciplined-than-ever approach to mastering financial stewardship.

Along the way, I have shared many pearls of wisdom from seasoned financial columnists and worthy experts. Having a BBS degree in Business Management from The University of Texas at Austin, I have compiled a wonderful collection of articles that are digested and archived at levitt.com/essays. The categories there include Homes, Cars, Wills, Social Security, Stockbrokers, Investing, Retirement, Tips, and Miscellaneous.

Listed above that collection, you’ll see Zola’s six essay topics, Dr. Tom McCall’s collected writings (on Israel, the Bible, Bible Interpretation, and History), and several articles by Dr. Todd Baker.

Two recent news pieces inspired me to sound a new knell for aspiring serpents:

- “[The New Fiduciary] Rule Doesn’t Mean Advisers Won’t Give Bad Advice,” by Michelle Singletary of The Washington Post, June 17, 2017.

- “Wall Street’s Self-Regulator Blocks Public Scrutiny of Firms with Tainted Brokers,” by Benjamin Lesser and Elizabeth Dilts, Reuters, June 12, 2017.

By and large, the U.S. Securities and Exchange Commission (SEC) relies on the Financial Industry Regulatory Authority (FINRA), a non-governmental agency, to regulate the securities industry. If ever self-regulation was an oxymoron, it’s when stockbroker cronies are appointed as foxes to guard the securities chicken coop. Talk about conflicts of interest on steroids! Don’t just take my word: Instead, please check the archive for the many sources that I have cited over the years to bring you up to speed.

The bottom line takeaway, per my favorite financial columnist, Scott Burns, is to rely on commission free, “couch potato” investment portfolios, described at scottburns.com/couch-potato-investing-turns-20/. Scott advocates Vanguard not because they walk on water but rather because they have extremely low expenses and don’t pretend to be able to time the market or cherry-pick stocks or market segments.

Do yourself a favor: Peruse the Serpent article topics at levitt.com/essays. Each article is short — only ~450 words long — and is designed to give you super stewardship insights in brief.

And do me a favor: While you are enjoying the quality of ZLM’s publications and broadcasts, remember that we offer the best value possible for your offerings, which we husband diligently.

Copyright © 2017 Zola Levitt Ministries